omaha nebraska vehicle sales tax

State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger Registration 2050. There are no changes to local sales and use tax rates that are effective January 1 2022.

Also effective October 1 2022 the following cities.

. The motor vehicle tax and motor vehicle fee replaced the property tax levied on motor vehicles beginning Jan. Registration fee for farm plated truck and truck tractors is based upon the gross vehicle. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

These plates will be valid for 30 days. Did South Dakota v. 29 000 For An Average Used Car In Us Would Be Buyers Are Aghast Search our Omaha Nebraska Sales And Use Tax database and connect with the best Sales And Use Tax Professionals and other Attorney Professionals in Omaha Nebraska.

What is the sales tax rate in Omaha Nebraska. The December 2020 total local sales tax rate was also 7000. The Nebraska state sales and use tax rate is 55.

Omaha NE Sales Tax Rate. State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger Registration 2050 Plate Fee 660. The County sales tax rate is.

The statewide sales tax for Nebraska is 55 for any new or used car purchases. Wayfair Inc affect Nebraska. There are no changes to local sales and use tax rates that are effective October 1 2021.

1500 - Registration fee for passenger and leased vehicles. The current total local sales tax rate in Omaha NE is 7000. You can drive your new car to Kansas after obtaining non-resident license plates at the County Treasurer from the county in which you purchased the car.

Repair labor on motor vehicles. This is the total of state county and city sales tax rates. The Nebraska state sales and use tax rate is 55 055.

The minimum combined 2022 sales tax rate for Omaha Nebraska is. The average cumulative sales tax rate in Omaha Nebraska is 686. Under the pre-1998 system motor vehicles were assigned a value by the Tax Commissioner based on average sales price for vehicles of that make age and model and the local property taxing units of government merely assessed the rate against that.

1819 Farnam Omaha NE 68183 402 444-7103. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15. Is Nebraska a good place to live.

County or City 2021 Net Taxable Sales 2020 Net Taxable Sales Percent Change 2021 Sales Tax 55 2020 Sales Tax 55 Adams 8106490 8481641 44 44656986. The Registration Fees are assessed. Youll also receive a temporary registration certificate.

What is Nebraska state sales tax rate. While some counties forgo additional costs most will charge a local tax on top of the state rate. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on top of the state tax.

The highest rate can be found in Gage Countyhome to a high concentration of car owners in the state. This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax. Free Unlimited Searches Try Now.

Youll need the title or Manufacturers Statement of Origin MSO and the fee of 2010. The Nebraska sales tax rate is currently. Registration fee for commercial truck and truck tractors is based upon the gross vehicle weight of the vehicle.

The average combined sales tax rate for Nebraska is 6324. Omaha in Nebraska has a tax rate of 7 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Omaha totaling 15. The Omaha sales tax rate is.

Registering a new 2020 Ford F-150 XL in Omaha. Ad Get Nebraska Tax Rate By Zip. This example vehicle is a passenger truck registered in Omaha purchased for 33585.

New Lincoln Cars Woodhouse Lincoln Of Omaha Luxury Omaha Cars

Nebraska Car Sales Tax Reviews And Estimates Getjerry Com

Chevy Cars Trucks Suvs For Sale Omaha Ne

Omaha Used Cars Trucks H H Automotive

Superlative 1927 Sinclair Aviation Gasoline Restored American Visible Gas Pump Model 2487 Barrett Jackson Auction Vintage Gas Pumps Gas Pumps Petrol Station

New Mercedes Benz Cars Trucks Suvs In Stock In Omaha Ne

Omaha Used Cars Trucks H H Automotive

Used Car In Greensboro Used Volvo Cars Crown Volvo Cars Serving High Point

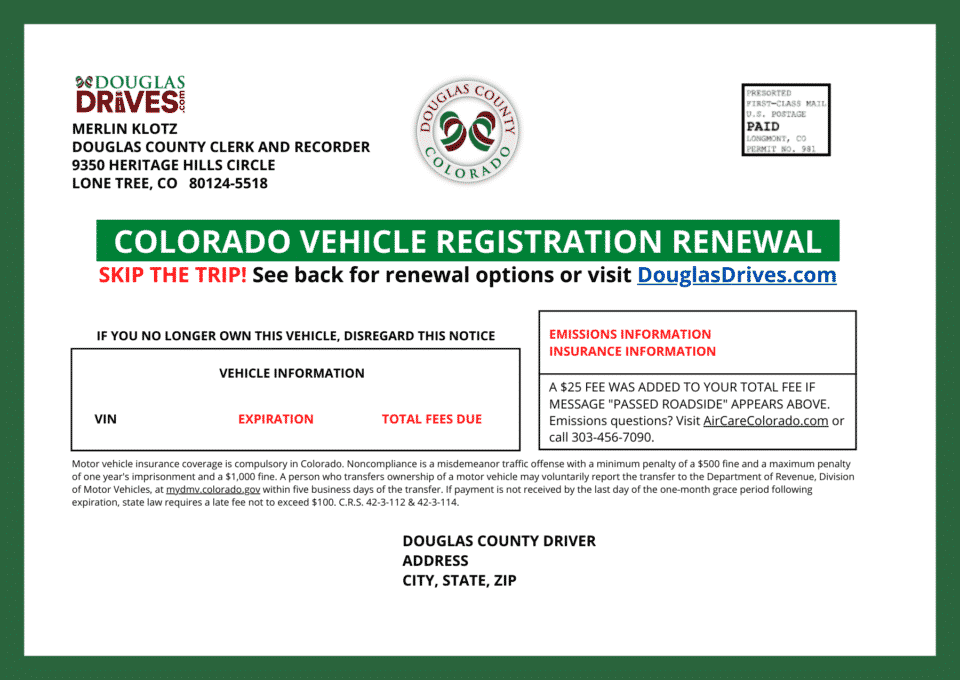

Renew Vehicle Registration License Plates Douglas County

New Honda Specials In Omaha Ne O Daniel Honda

New Honda Specials In Omaha Ne O Daniel Honda

Certified Pre Owned 2018 Lincoln Mkx Reserve Sport Utility In Omaha Fa43804a Baxter Auto Group

All About Bills Of Sale In Nebraska The Forms And Facts You Need

Used Cars For Sale Under 8 000 In Omaha Ne Cars Com

Rene Ricard David Shapiro Rene Ricard Vintage Poetry Tombstone Print Carved In Stone Lithograph Pop Art Artist